do nonprofits pay taxes on interest income

If the IRS approves your long-term payment plan installment agreement a setup fee may apply depending on your income. In order to take advantage of reduced real estate taxes you must maintain ownership of a home or other property for more than one year.

What Is The Difference Between A Nonprofit And An Llc

Long-term payment plan The payment period is longer than 120 days paid in monthly payments and the amount owed is less than 50000 in combined tax penalties and interest.

. Income receipts from rental real estate royalties partnerships S corporation trusts. Form 1099-G showing any refund credit or offset of state and local taxes. Form 1099-INT showing interest paid to you throughout the year.

As far as the effect the length of time youve owned a home is concerned any real estate in New York that is purchased and sold within a year is subject to being taxed as ordinary income at the applicable 35 rate. W-2s showing your annual wages from all of your employers.

Tax Deduction Rules For Nonprofit Organizations Download Table

Month End Closing Checklist Aplos Academy Checklist Business Basics Educational Articles

When You Need Your Taxes Done Right Help Is A Phone Call Away Location Does Not Matter We Prepare U S Federal Income Tax Tax Preparation Payroll Taxes

What Is The Difference Between Nonprofit And Tax Exempt Start A Non Profit Nonprofit Startup Nonprofit Marketing

Unrelated Business Taxable Income For Nonprofits Sd Mayer

This Perhaps Is The Most Favorite Subject Of Taxpayers And Many Of Them Already Know A Lot About It We Beli Income Tax Preparation Income Tax Tax Preparation

Tax Free Income Personal Finance Budget Smart Passive Income Income

A Sample Chart Of Accounts For Nonprofit Organizations Altruic Advisors Chart Of Accounts Accounting Dental Insurance

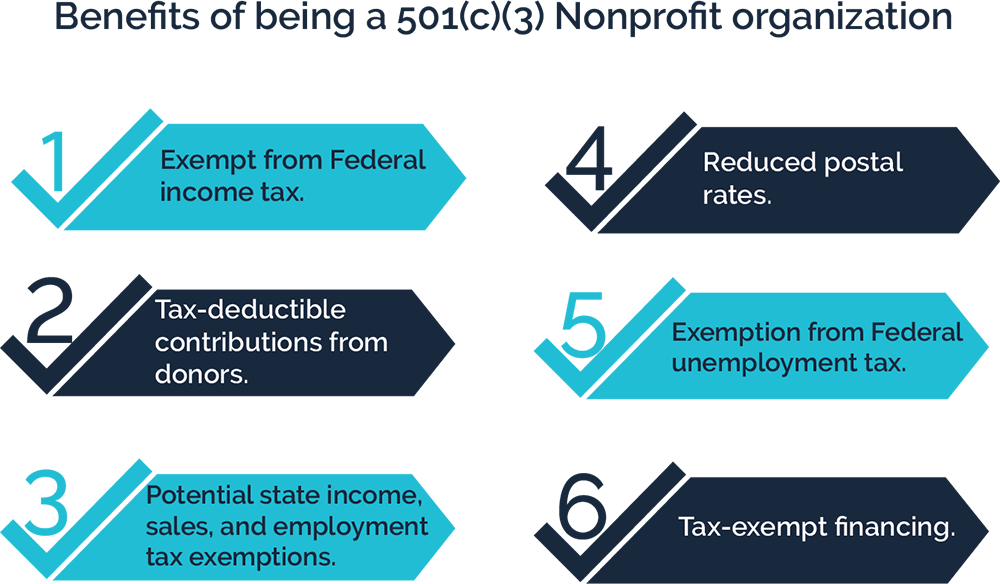

Non Profit Tax Exemptions Tax Exemption Non Profit Federal Income Tax